|

The new dynamics of competition: fascinating read for memorial day that explores an emerging science for modeling strategic moves – and challenges Michael Porter’s five forces model. [Reproduced from Harvard Business Review] The New Dynamics of Competition [by Michael D. Ryall / 05.27.13] In his book Innovation and Entrepreneurship, Peter Drucker made this observation about industries that rely on knowledge-based innovation: “For a long time, there is awareness of an innovation about to happen...Then suddenly there is a near-explosion, followed by a few short years of tremendous excitement, tremendous start-up activity, tremendous publicity....Later comes a ‘shakeout,’ which few survive.” The problem, Drucker argues, is that knowledge-driven innovations are “almost never based on one factor but on the convergence of several different kinds of knowledge.” The initial breakthrough generates a spate of activity, but meaningful progress occurs only after all the pieces are in place. I cannot attest to the scientific merit of Drucker’s claim, but I consider it to be a remarkably accurate description of the field of strategy. In its early days strategy was a loose affair. Content originated either from commonsense approaches such as SWOT analysis or from frameworks like the Boston Consulting Group’s growth-share matrix. In 1979, however, Michael Porter’s five forces model changed the field forever. It masterfully synthesized the practical implications of economic research on industrial organizations from the 1960s and 1970s. Knowledge-based innovation put strategy on the map as a field of study, virtually overnight. Competitive Strategy, Porter’s practitioner-oriented book, became an enormous success. Porter’s ideas generated immediate excitement. They prompted interest from researchers in other fields and the establishment of the Strategic Management Society and the peer-reviewed Strategic Management Journal. A flurry of papers made informally reasoned claims about the causes of persistent performance differences across firms. Theories such as the resource-based view, dynamic capabilities, and transaction-cost economics appeared, and an avalanche of empirical work quickly followed. Another seminal concept, though not as popular with practitioners as Porter’s proved to be, came in 1996, when Harvard Business School’s Adam Brandenburger and Harborne Stuart Jr. proposed “value-based business strategy.” That work has bred an extensive body of literature on strategy by mathematical economists. From that backdrop, a general model of competitive strategy, which I call the value capture model (VCM), has emerged. It uniquely applies the mathematical concept of cooperative game theory to research on business strategy. (“Cooperative” is a misnomer, as the math focuses on competitive dynamics.) As such, the VCM has an explanatory, predictive potential that no other theory of competitive strategy, including Porter’s, can claim. The model is a work in progress, but scholars are starting to use it to explain the dynamics of competition and to identify practical implications for strategic decision making. At the VCM’s core is this axiom: “The value that any party can capture from engaging in transactions with a given set of parties is bounded by the value each of them can add to parties outside the set.” In this article I will explain the axiom and its implications for how we need to think about strategy. Redefining Competition: From Five Forces to One In most industries, a firm, its suppliers, and its customers all have choices about how and with whom they create value. To produce more value, they may change how they engage in transactions with existing suppliers and customers or may switch to other suppliers and customers. Those agents, in turn, have similar alternatives in how they transact with the original firm and with their own suppliers and customers. That reality suggests a formal definition of competitiveness that applies equally to all the firms, suppliers, and customers in an industry: a tension between the value generated from transactions that a firm undertakes with a given set of agents and the forgone value it could have generated from transactions with other agents. That definition enables you to assign formal identities to the agents involved; to place them in a mathematical game-theory model; and, with given measures of competitive tension, to examine the payoffs from their investments in resources and capabilities. You can also bring big data—from enormous databases that track consumer behavior and spending, stock prices, company accounts, and so on—to bear on this work. No other current theory of strategy offers the ability to model the effect of strategic decisions so precisely or to use data to test hypotheses about what kinds of management processes or investments improve a given firm’s ability to capture value in its industry.

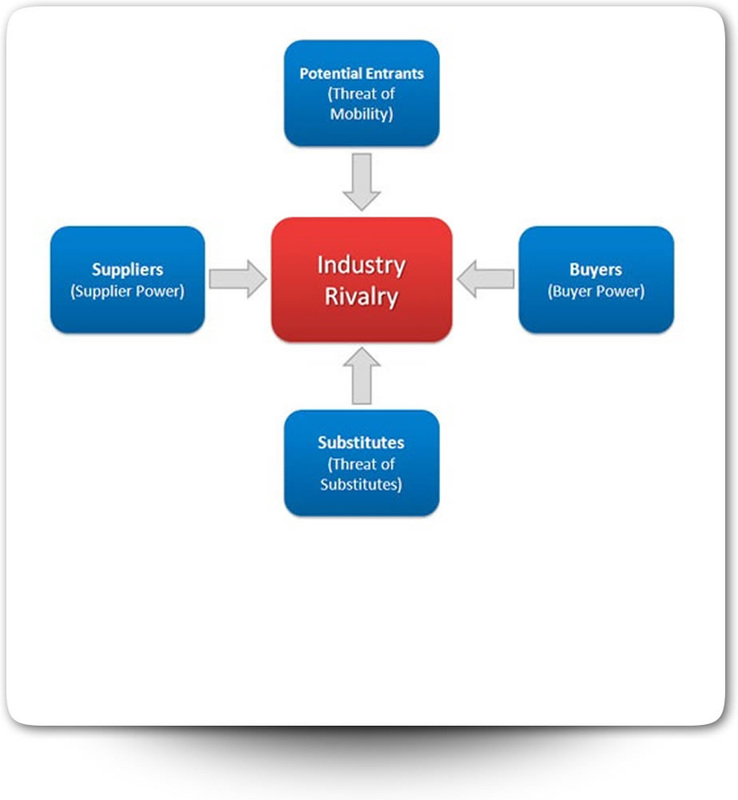

The VCM model differs from Porter’s framework in two significant ways. First, Porter defines the opportunities of a firm largely by the power that other agents may or may not have over it (buyer power, supplier power, threat of entry by new agents, threat of substitute products brought by existing or other agents, and rivalry from other similar firms). The idea that other agents might compete for the firm remains buried as a moderating factor of each agent’s power over that firm. By bundling competition with different types of players, Porter creates unnecessary complexity. The VCM definition, by contrast, has only one force of competition that works transparently in multiple directions: Suppliers compete for firms, and vice versa; firms compete for customers, and vice versa. In sum, each player in an industry (whether a firm, a customer, or a supplier) experiences a single force of competition for itself. The intensity of that force is measured by the tension between the value the player creates with a given set of parties and the value it could create with others. The greater the alternative value relative to the value actually created, the greater the intensity. The relative intensities of the force determine how much value each player stands to win. Second, the VCM makes a clear distinction between the value created by the transactions of market participants and the value appropriated by each participant. To be sure, a VCM analysis relies on the former to derive implications about the latter, but the distinction is crucial. Again, Porter buries the distinction so deeply that it is almost lost. Indeed, many people perceive his framework (probably unfairly) as a value-appropriation model, which may explain why many competing informal theories of strategy (such as Christensen’s disruptive innovation or Kim and Mauborgne’s blue ocean strategy) emphasize value creation rather than value appropriation. From Value Chain to Value Network The VCM offers a new way for practitioners to map a firm’s competitive landscape. Traditionally, and certainly in Porter’s framework, value is seen as the product of a chain of activities: A firm takes material from suppliers, adds some value, and sells a product to customers. It haggles with suppliers and customers over price, and its profitability depends on the appeal of its value-price proposition to customers relative to that of other companies. The VCM framework replaces the firm’s value chain with what I call a value network map—essentially, a productive social network with linkages defined by actual and potential transactions. The map has two major components, as shown in the exhibit “A Different View of Value Appropriation.” The first is the firm’s value network, which comprises the agents (typically, suppliers and customers) who conduct actual, value-creating transactions with the firm. If no opportunities to create value exist beyond the network itself, there is no competition. Competition renders undeniable certain claims on the value produced. Without competition, the parties are left haggling among themselves, each attempting to persuade the others of the value they merit. Competition arises from the second component of the value network map: agents outside the network that wish to transact with agents inside the network but that, for some reason, are not currently allowed to engage in such activity. For example, suppose that manufacturer A wants to sell through retail outlet B, but scarce shelf space prevents the transaction from occurring. In the VCM, the collection of all such agents is the value network’s competitive periphery. When agents in the periphery wish to transact with a firm, that firm’s capture of the value created by the network is likely to increase. That’s because if the firm is offered too little in return for its activities within the network, it can choose to cut its transactional ties and form a new network with agents in the periphery. Who occupies the competitive periphery? All the entities identified by Porter are certainly there: A firm’s rivals offer alternative opportunities to its suppliers and its customers, as do potential entrants and substitute firms in nearby industries. That reality erodes the firm’s ability to appropriate value, as Porter emphasized. But the periphery also includes the rivals of current suppliers and customers (those the firm does not deal with now but could) and potential entrants and firms from nearby industries. The credible threat to replace a supplier or customer with a well-poised substitute increases the firm’s appropriation from its suppliers and customers. Consider Amazon in the early years of online book retailing (1994–2001), when it experienced persistent losses despite rapid sales growth and revolutionary technology. (See the exhibit “A Different View of Value Appropriation.”) Any buyer who cared to transact with Amazon could do that, so Amazon’s competitive periphery (the agents that might compete for it) was empty. Interestingly, this problem stemmed directly from Amazon’s innovation: The shift from brick-and-mortar to online retailing effectively eliminated capacity constraints. For example, I was an early Amazon customer, as it was a terrific source of mathematics monographs not typically stocked by its brick-and-mortar rivals. I never had to stand in line to buy a book, put in a bid for a limited customer slot, or worry that another Amazon enthusiast might jostle me out of my relationship with the company. To make matters worse, the online arm of Barnes & Noble happily offered Amazon’s customers alternative transactions of comparable value. Back then, so little differentiation between the online book retailers existed that small price discrepancies could induce switching within seconds, a few mouse clicks away. Thus, the periphery of the buyers provided strong competition for them. Not surprisingly, markups for Amazon’s service were low, allowing customers to appropriate the lion’s share of the value in the market at that time. Factoring In the Strategic Decision So far, my description of the VCM has focused on variables beyond the control of individual firms—specifically, the agents in their existing value networks and the degree of competition for those agents as determined by the presence of alternative network partners. But those variables rarely dictate the exact value a firm ends up capturing. Rather, they set an upper and a lower limit for the share of value in a network that a firm can capture. Although the effects of competition can sometimes be subtle, the intensity of competition for the firm’s partners in the network determines the upper boundary, and the intensity of competition for the firm dictates the lower boundary. The value actually captured is, of course, a consequence of the firm’s strategic decisions. We all intuitively know that firms can affect competitive opportunities and outcomes through their choices about which capabilities and resources to invest in. Formal applications of cooperative game theory mathematics to VCM-type strategy models not only confirm that intuition but also allow us to understand and predict how strategic decisions affect outcomes. That’s where the VCM’s distinction between value creation and value appropriation becomes important. A firm’s strategic investments in capabilities and resources can be measured on two dimensions: the effect of the capabilities and resources on the actual and potential value that partners in a network create, and the extent to which they enhance the ability of a firm to pry value from its transaction partners. Resources and capabilities that influence value, whether actual or potential, are deployed with competitive intent. By contrast, resources and capabilities developed to persuade a firm’s transaction partners to give up value, beyond what competition dictates, are deployed with persuasive intent. Typically, a firm uses competitive capabilities and resources to increase the range of value (the minimum, the maximum, or both) that is available for capture, consistent with the competitive intensities of its situation. So a deployment of resources that drives a minimum value up to the level of a maximum value benefits the firm, especially if its persuasive resources are weak. Competitive resources are usually easy to identify. A firm’s products and services, productive assets, innovation skills, and customer service quality all affect the value that the firm creates within its network and that it could create with agents in its competitive periphery. Advertising is also competitive: It may be designed to increase customers’ willingness to pay for the firm’s own product (by enhancing brand image, for instance) or to reduce customers’ willingness to pay for a competitor’s product, thereby weakening competition for the customers from entities in their peripheries. Such activity usually increases a firm’s maximum capturable value. Alternatively, comparative advertising may increase the willingness to pay of potential buyers who are not current customers of the firm, thereby intensifying competition for the firm from the periphery and increasing the firm’s minimum capturable value. In practice, ads are often designed to achieve both effects. For instance, when General Motors touts its OnStar service in an advertisement and points out that other automakers don’t offer it, the company is aiming to increase the attractiveness of its cars and decrease that of its rivals’ vehicles. Similarly, ads for a sleep aid that mention the product is “not habit-forming” provide a not-so-subtle dig at rival products. Persuasive resources and capabilities become relevant when competitive intensity is sufficiently loose to create a gap between a firm’s minimum and maximum levels of capturable value. In such situations, a firm may make investments in resources and capabilities to get network partners to relinquish value; such activity may even be the prime driver of profits. For example, car dealers often use elaborate sales techniques to get buyers to part with value. To see how these types of resources come together, consider Apple, whose own foray into online sales yielded a very different outcome from Amazon’s. Apple launched iTunes in 2001, and by 2010 it was the largest global music vendor. According to some estimates, the company earned a 30% gross margin on $1.4 billion in iTunes revenue for 2011. When it comes to physical goods, like those sold by Apple, firms can use capacity as a competitive resource to keep their peripheries populated by limiting the number of agents with which the firm can transact. For example, Apple limited the supply of iPods when it introduced them in 2001 and thereby ensured competition for itself. The proprietary iTunes song format also linked the scarcity of Apple’s physical devices to its digital content, and the appeal of the design of Apple’s products kept buyers unusually loyal. The buyers’ own peripheries were populated with other digital music and device providers, but loyalty to Apple lowered the relative value of transacting with them, thereby weakening competition for Apple’s customers. The complementary nature of Apple’s product ecosystem has been much discussed; in VCM terms, the increased value from the iTunes store, particularly for buyers with multiple Apple devices, and the weakening of Apple’s competitive periphery increased the company’s maximum value available for capture. The stories of Amazon and Apple illustrate an important contrast. In Amazon’s case, book suppliers shipped physical products that were limited in number through a distributor with more or less unlimited transaction capacity. In Apple’s case, the content suppliers provided licenses for music, an activity with no inherent capacity, so the suppliers’ commitments to keep their peripheries populated were not credible. Meanwhile, Apple capped distribution by tying its digital content to its own products using proprietary file formats. Apple established some distance between its minimum and maximum quantities of capturable value, and its persuasive resources also came into play. Persuasive resources get a firm’s transaction partners to relinquish value beyond the amount proscribed by competition. One way to achieve this aim in a mass retail market is to control pricing at the point of sale, which permits the firm to make credible take-it-or-leave-it offers to its buyers. That technique unravels when it becomes economically attractive for buyers to haggle, as with big-ticket purchases like cars, or if the gap between the minimum and the maximum appropriable value decreases. Indeed, Amazon’s control of the point of sale had little advantage because the similarity of Barnes & Noble’s online offering kept the gap very narrow. Quantifying the Outcome The exact effects of strategic choices on a firm’s value network and competitive periphery are hard to predict. But armed with a VCM-based mathematical model, managers can estimate those effects more precisely. Indeed, in the VCM model, a firm’s minimum and maximum value-appropriation levels (defining the range of value the firm can capture) are the solutions to problems in linear programming, a very well understood analytical technique that can be conducted in Excel. A useful real-world example comes from a case study, which I am coauthoring, on Evan Kristen Specialty Foods (EKSF). In it, a venture capitalist must evaluate a business plan from EKSF, a start-up that plans to sell washed, de-stemmed, fresh herbs in the produce section of retail grocery stores year-round. EKSF aims to create a value network with nontraditional participants. Those include FedEx as the distributor (bypassing standard produce warehousing and shipping requirements), original equipment manufacturers as suppliers of custom processing equipment and in-store refrigerated displays, the maker of an IP-protected shipping refrigerant, an in-house staff of retail merchandisers (unheard of in produce), and a collection of growers in a location amenable to year-round production, near Watsonville, California. Standard industry rules of thumb do not apply in this unusual scenario. The VCM, however, allows the venture capitalist to assess competitive intensity for all players in EKSF’s innovative value network. Comparing the resulting analysis with the financial projections in the business plan enables the potential investor to distinguish the amount of projected profit, given the predictable competition, from the amount that would come from persuasive resources. (Investors usually perceive profits locked in by competitive forces as less risky.) The analysis provides insight into the balance and evolution of competitive intensities affecting all the agents in the value network. Tight capacity constraints for the start-up imply strong competition for it from customers in its competitive periphery. Upstream, the periphery is essentially empty for several of the nontraditional suppliers mentioned above, as it is (on the supply side) for EKSF. In other words, EKSF and the suppliers have no alternative but to form a network with each other. However, a medium-term threat emerges, just as the venture capitalist is thinking about an exit strategy. Specifically, the VCM reveals that if EKSF succeeds, the efficacy of its innovative value network will be proven, and the competitive peripheries of its unusual suppliers will fill up more quickly than its own, thereby squeezing profits. Planning for that possibility is therefore important, and that means acquiring a patent license from the refrigerant supplier. Strategy is a complex domain, and social science progresses in fits and starts. Therefore, it might be a decade before the VCM can provide practitioners with a turnkey managerial tool. Nevertheless, work on the VCM is already revealing important insights for leaders who aim to chart a strategic direction for their firms. If scholars in the field of strategy do succeed in creating a streamlined version of the model with a reasonably full complement of input variables, it will become an important theoretical paradigm. Empirical research findings will then refine the model, which will illuminate the way to better business practices in a virtuous, recursive cycle of discovery and innovation.

0 Comments

Leave a Reply. |

Head of Product in Colorado. travel 🚀 work 🌵 weights 🍔 music 💪🏻 rocky mountains, tech and dogs 🐾Categories

All

|

RSS Feed

RSS Feed